Why would

Microsoft pay per unit Zune royalties to Universal Music?

For the same reasons that 70c of every dollar spent at ITunes goes to the record company - they own the unique resource, and if you want to use those resources (legally), you have to pay the monopoly rent they demand.

Keen students will note that the margin for ITunes is a mere 30c per download; projecting that competition, primarily based on end-user price, will arrive from Napster, Zune etc. who are the only parties in this collaboration likely to be long term winners?

That's right: those pesky copyright holders, the record companies.

Margins for the reseller will be eroded over time, as the dumbest player on the block tries to capture share by dumping their margin. Do you think it is likely the record companies will drop their prices? Not at all; in fact,

they are already trying the opposite.

If you analyse this carefully, the real money for MSFT in digital music is in the sale of the device, not the music.

Without a device to drive real profits to them, resellers like Napster are going to get squeezed, just like Intel squeezed their entire value chain more than 10 years ago with Intel Inside. They will be squeezed by end user price cuts and squeezed by supply side input price hikes. Napster have been good enough to mention these risks in their most recent 10K SEC filing:

"We rely on content provided by third parties, which may not be available to us on commercially reasonable terms or at all. "

"If we lower our prices [to compete with lower priced competition], our gross margins and operating results will be adversely affected. If we do not lower our prices, we may be unable to compete with discount services."

Ouch.

MSFT may just have hit on a smart way to avoid at least one end of that squeeze.

Labels: bubblegeneration, copyright, idiot, ITunes, Microsoft, Napster, Umair Haque, umairhaque, web 2.0, Zune

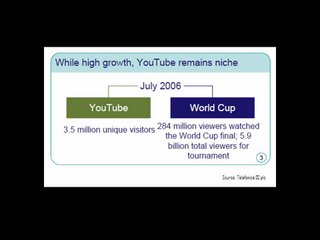

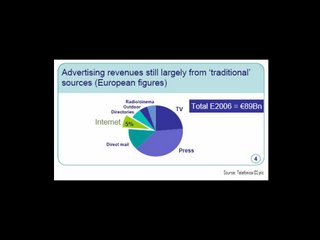

Maybe some of those webbies are just a little itty bit ahead of themselves?

Maybe some of those webbies are just a little itty bit ahead of themselves?